In the realm of finance and investing, technical analysis plays a vital role in helping traders and investors make informed decisions on when to buy or sell securities. One popular chart pattern that traders often look out for is the double top pattern. Today, we’ll explore how the double top pattern has manifested in the world of semiconductors, particularly in the SMH (VanEck Vectors Semiconductor ETF).

### Understanding the Double Top Pattern

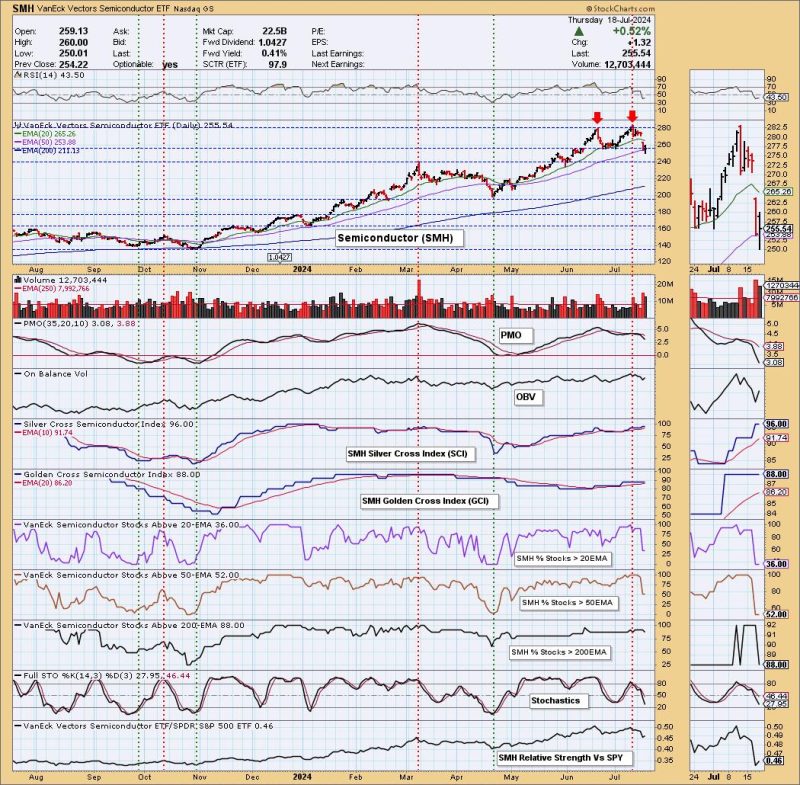

The double top pattern is a bearish reversal pattern that signifies a possible trend reversal from an uptrend to a downtrend. It consists of two peaks at approximately the same level, separated by a trough. The pattern is confirmed when prices break below the trough support level, indicating a shift in trend direction.

### An Analysis of SMH (VanEck Vectors Semiconductor ETF)

As highlighted in the article on Godzilla Newz, the SMH ETF exhibited a double top pattern on its price chart. This pattern suggests a potential reversal in the uptrend that SMH had been experiencing. It serves as a warning sign for investors and traders who were bullish on the semiconductor sector, signaling the need for caution and possibly a change in strategy.

### Implications for Investors

For investors holding positions in semiconductor-related stocks or the SMH ETF, the emergence of a double top pattern could prompt a reevaluation of their investment thesis. It may be a signal to consider taking profits or tightening stop-loss orders to protect against potential downside risk. Additionally, for traders looking to capitalize on the pattern, taking a short position or implementing options strategies could be considered.

### Risk Management and Strategy

When dealing with chart patterns such as the double top, risk management is paramount. Setting clear exit points, implementing stop-loss orders, and adhering to a disciplined trading plan are essential practices to mitigate potential losses and maximize profits. Traders should also consider the broader market environment, fundamental factors affecting the semiconductor industry, and upcoming events or earnings reports that could impact SMH and related stocks.

### Conclusion

In conclusion, the double top pattern observed in the SMH ETF serves as a valuable lesson for investors and traders alike. It highlights the importance of technical analysis in identifying potential trend reversals and adjusting investment strategies accordingly. By staying informed, practicing prudent risk management, and adapting to changing market conditions, market participants can navigate the complexities of the financial markets with greater confidence and success.