The article provided as a reference discusses the ongoing secular bull market and the significant rotation happening within the market sectors. The evolution of the market reflects an apparent shift in investment strategies as investors adjust their portfolios to maintain profitability and mitigate risks.

To elaborate further on this topic, it is crucial to delve into the concept of a secular bull market. A secular bull market is characterized by an extended period of rising stock prices and economic growth, typically lasting a decade or more. This phase is fueled by various factors such as economic strength, low interest rates, and investor confidence. In contrast to a cyclical bull market, which lasts for a shorter period and is driven by specific market conditions, a secular bull market is a more sustained and broad-based trend.

The current secular bull market has been ongoing for several years, bolstered by unprecedented fiscal and monetary stimulus measures, robust corporate earnings, and a global economic recovery following the COVID-19 pandemic-induced downturn. However, despite the overall positive trajectory of the market, there has been a noticeable rotation taking place among different sectors and industries.

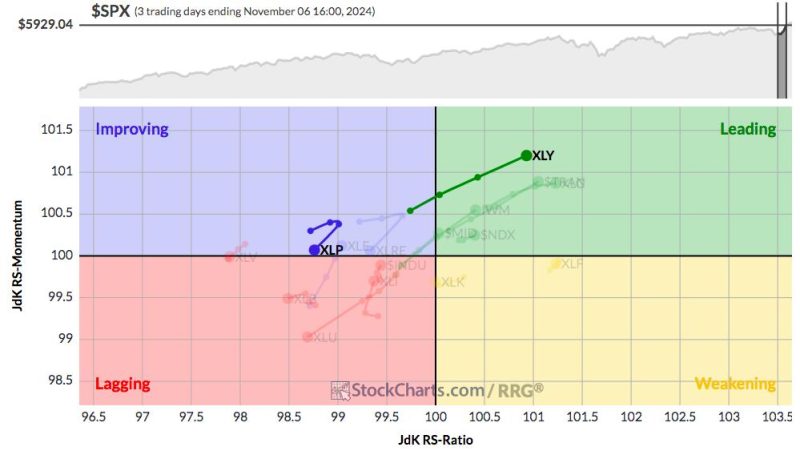

The rotation within the market refers to the shifting preferences of investors towards specific sectors or asset classes based on changing economic conditions, market dynamics, and investment outlook. In recent months, there has been a pronounced rotation from growth stocks to value stocks, signaling a potential change in market leadership. Growth stocks, which typically outperform during periods of economic expansion, have faced headwinds due to concerns over inflation, rising interest rates, and stretched valuations. On the other hand, value stocks, which are perceived as undervalued based on fundamental metrics, have gained traction as investors seek more defensive and reasonably priced assets.

Moreover, the rotation within the market extends beyond just growth versus value stocks. Investors have also been reallocating their capital towards sectors that are poised to benefit from specific trends or thematic drivers. For example, renewable energy, electric vehicles, technology, healthcare, and infrastructure are among the sectors that have attracted significant investor interest due to their growth potential and alignment with broader societal and economic trends.

As the market continues to evolve, it is essential for investors to remain vigilant, stay informed about market developments, and regularly review their investment portfolios to ensure alignment with their financial goals and risk tolerance. Diversification across asset classes, sectors, and geographies can help investors navigate market volatility and capture opportunities presented by different market cycles.

In conclusion, the ongoing secular bull market presents a compelling investment backdrop, but investors need to be mindful of the shifting market dynamics and sector rotations. By staying informed, maintaining a diversified portfolio, and adapting their investment strategies to changing market conditions, investors can position themselves to capitalize on the opportunities and navigate the challenges of an evolving market environment.