Certainly! I will craft a well-structured and unique article based on the reference link you provided.

The stock market is always a hotbed of activity, with investors in a constant state of anticipation and analysis. For those keeping a close eye on the Nifty index, the upcoming week presents a picture of possible range-bound movement with the potential for trending moves if specific levels are breached.

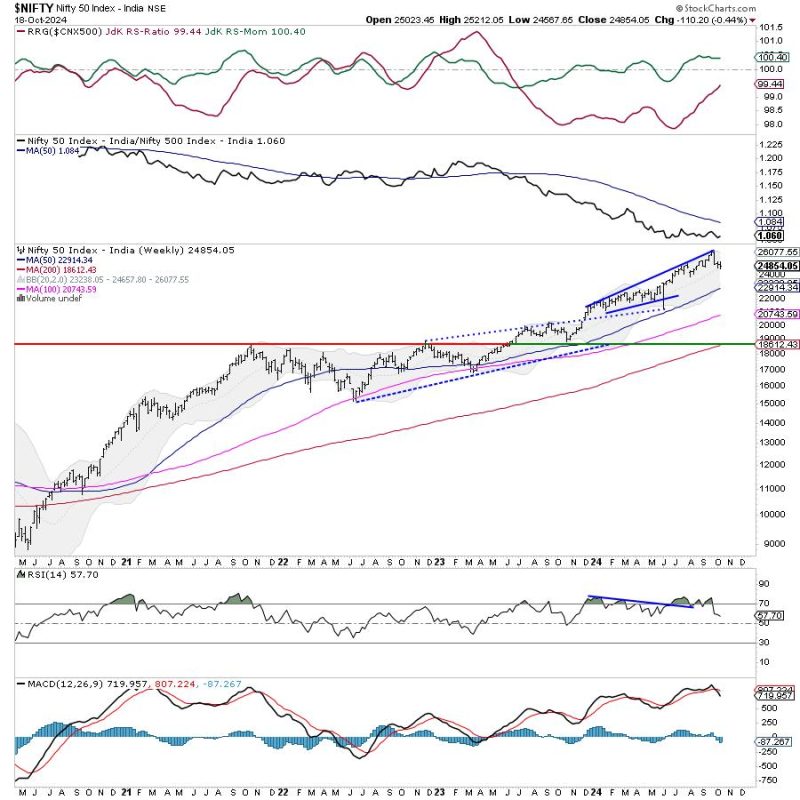

Technical analysts have identified key levels that could dictate the direction in which the Nifty moves in the coming days. While staying within a range is a possibility, the possibility of significant moves exists if certain critical edges are breached.

One such crucial level is the immediate support near 15,000 points. Should the Nifty break below this level, it could indicate a shift in market sentiment towards the bearish side. On the other hand, a decisive move above the current resistance around 15,270 points could pave the way for a bullish trend to unfold.

Market participants are advised to keep a close watch on these levels and act accordingly based on the breach of these key edges. Traders utilizing technical analysis methods are likely to base their strategies on these levels to capitalize on potential trending moves.

Additionally, external factors such as global market trends, economic indicators, and geopolitical events could also influence the Nifty’s trajectory in the upcoming week. Investors are encouraged to maintain a flexible approach and adapt their strategies based on evolving market conditions.

In conclusion, while the Nifty may stay range-bound in the immediate future, the possibility of trending moves exists if specific edges are breached. Keeping a watchful eye on critical support and resistance levels can provide valuable insights for investors looking to capitalize on potential market moves. By staying informed and adaptable, market participants can navigate the upcoming week with confidence and strategic acumen.