Investing in the Future with AlphaFold Stock

AlphaFold, the groundbreaking artificial intelligence (AI) system developed by DeepMind, has garnered significant attention for its ability to revolutionize the field of structural biology. Investors are eager to capitalize on the potential of this cutting-edge technology, but navigating the world of investing in AlphaFold stock can be complex. In this article, we will delve into the key considerations and strategies for those looking to invest in AlphaFold stock.

Understanding AlphaFold and its Potential

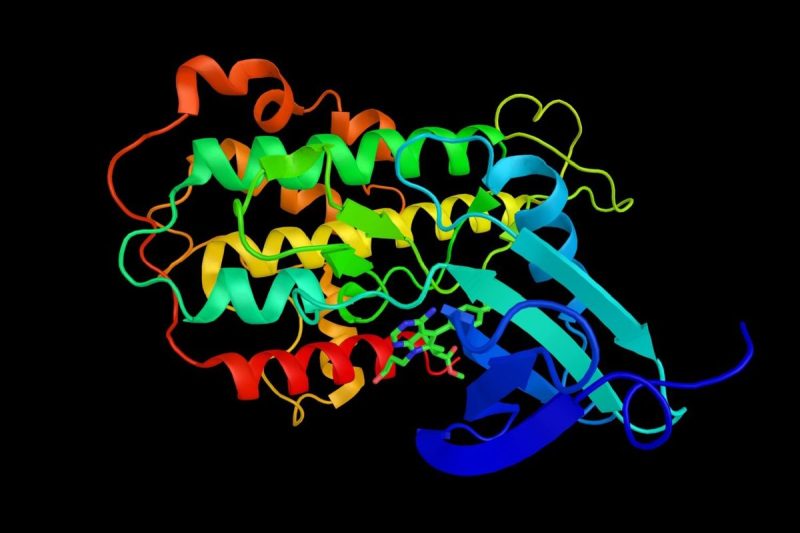

Before delving into the intricacies of investing in AlphaFold stock, it is crucial to understand the technology and its potential impact. AlphaFold uses advanced AI algorithms to predict protein structures with remarkable accuracy, a feat that has the potential to revolutionize drug discovery, disease treatment, and other areas of life sciences research. This disruptive technology has already attracted interest from pharmaceutical companies, biotech firms, and research institutions worldwide.

Analyzing the Investment Opportunities

Investing in AlphaFold stock presents a unique opportunity to tap into the growth potential of a transformative technology. However, investors should carefully assess the risks and potential returns associated with this investment. As with any emerging technology, there are uncertainties surrounding the commercial viability of AlphaFold and its ability to generate sustainable revenue streams in the long term.

Key Factors to Consider

When evaluating the investment potential of AlphaFold stock, several key factors should be taken into account:

1. Technology Leadership: DeepMind’s leadership in AI and machine learning technologies positions AlphaFold as a frontrunner in the field of structural biology.

2. Market Potential: The global market for protein structure prediction tools is expected to grow rapidly, creating a lucrative opportunity for AlphaFold.

3. Competitive Landscape: Investors should consider the competitive landscape and assess how AlphaFold stacks up against other players in the market.

4. Regulatory Environment: Regulatory considerations, particularly in the healthcare and pharmaceutical sectors, can impact the adoption and commercialization of AlphaFold technology.

Strategies for Investing in AlphaFold Stock

For investors looking to capitalize on the potential of AlphaFold stock, several strategies can be considered:

1. Long-Term Investment: Given the nascent stage of AlphaFold’s commercialization, a long-term investment approach may be suitable for investors seeking to benefit from the technology’s growth trajectory.

2. Diversification: Diversifying your investment portfolio with a mix of established and emerging technologies can help mitigate risks associated with investing in a single stock.

3. Stay Informed: Keeping abreast of the latest developments in the field of structural biology and AI can help investors make informed decisions about their AlphaFold investments.

4. Seek Expert Advice: Consulting with financial advisors or industry experts can provide valuable insights and guidance on investing in AlphaFold stock.

Closing Thoughts

Investing in AlphaFold stock offers a compelling opportunity to participate in the growth of a disruptive technology with the potential to shape the future of life sciences research. By carefully evaluating the risks and opportunities associated with this investment and adopting a strategic approach, investors can position themselves to benefit from the innovative capabilities of AlphaFold and the transformative impact it could have on the industry.