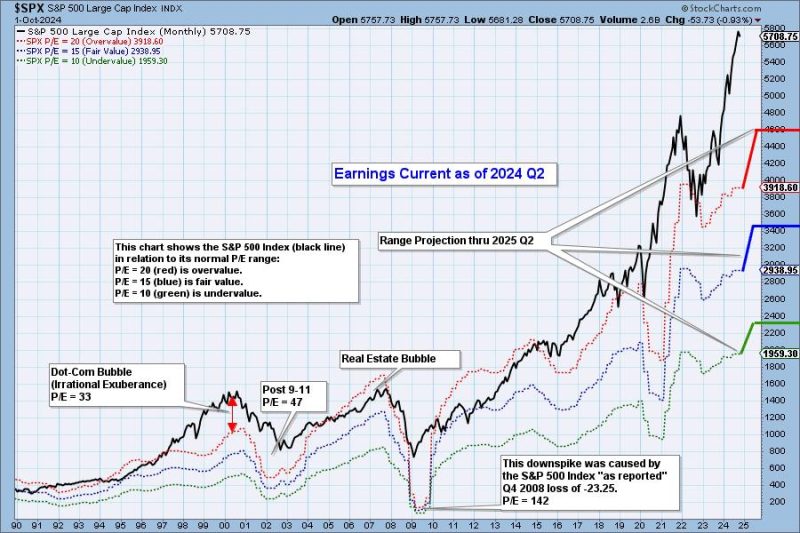

As of the second quarter of 2024, the market continues to show signs of overvaluation, with certain sectors experiencing significant price discrepancies that may warrant caution from investors. The current state of the market can be attributed to a variety of factors, including economic conditions, investor sentiment, and external events impacting the valuation of companies and assets.

One of the primary drivers of the overvaluation in the market is the prevailing economic conditions. Despite signs of a recovery from the economic downturn experienced in previous years, there are concerns about the sustainability and pace of growth. Inflationary pressures, supply chain disruptions, and geopolitical tensions all contribute to uncertainty and volatility in the market, leading to inflated valuations that may not be fully supported by fundamentals.

Investor sentiment also plays a crucial role in determining market valuations. The prevailing optimism among investors, driven by factors such as low interest rates, fiscal stimulus, and strong corporate earnings, has contributed to a bullish market environment. However, excessive exuberance and a tendency towards speculative behavior can lead to asset bubbles and unsustainable valuations, posing risks to the stability of the market in the long term.

External events, such as geopolitical tensions, regulatory changes, or natural disasters, can also impact market valuations by introducing additional uncertainties and risks. These events can trigger market volatility and result in sudden price fluctuations, further exacerbating the overvaluation observed in certain sectors. Investors need to closely monitor and assess the potential impact of such events on their investment portfolios to mitigate risks and make informed decisions.

In conclusion, the market remains very overvalued as of the second quarter of 2024, driven by a combination of economic conditions, investor sentiment, and external events. While there are opportunities for growth and returns in the current market environment, investors should exercise caution and conduct thorough due diligence to avoid potential pitfalls associated with overvaluation. By staying informed, diversified, and prepared to adapt to changing market conditions, investors can position themselves strategically to navigate the uncertainties and challenges of an overheated market.