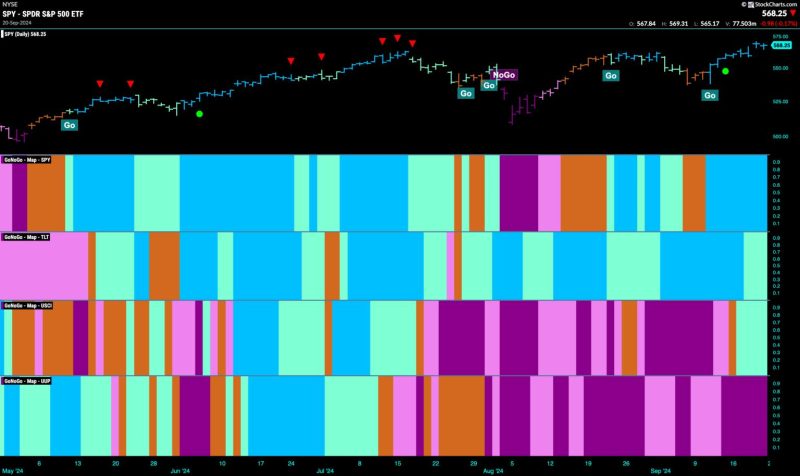

Equities Remain in Strong Go Trend Powered by Financials

The recent surge in equities has continued steadfast, with financial sectors playing a pivotal role in sustaining the market’s upward momentum. The signs are clear – the Go trend in equities remains robust, driven by a combination of factors that have buoyed investor confidence and fueled optimism in the financial markets.

Stellar Performance of Financial Sector Giants

Leading the charge in this current bullish trend are the financial sector giants, which have demonstrated exceptional resilience and strength in the face of economic uncertainties and global challenges. Companies such as JPMorgan Chase, Bank of America, and Goldman Sachs have posted impressive financial results, surpassing market expectations and reaffirming their positions as industry leaders.

These financial powerhouses have successfully navigated the complexities of the current economic landscape, leveraging their expertise, resources, and strategic capabilities to capitalize on emerging opportunities and mitigate risks. Their solid performance has not only bolstered investor sentiment but also underscored the stability and long-term growth potential of the financial sector.

Rising Interest Rates and Inflation Expectations

The recent uptick in interest rates and inflation expectations has also played a significant role in driving the equity markets higher, particularly benefitting financial companies with diversified revenue streams and strong balance sheets. As inflationary pressures mount and interest rates edge higher, financial institutions stand to benefit from wider net interest margins and increased profitability, further fueling the sector’s outperformance.

Furthermore, the prospect of a stronger economy and robust corporate earnings growth has provided additional support to equities, with financial stocks being among the prime beneficiaries. As economic indicators continue to improve and business confidence remains high, investors are increasingly turning to financial sector stocks as a safe haven for their capital, contributing to the sector’s sustained outperformance.

Technological Innovation and Digital Transformation

In addition to traditional strengths, financial companies have also embraced technological innovation and embarked on a path of digital transformation to enhance their competitive edge and adapt to changing market dynamics. Fintech companies, in particular, have revolutionized the financial services industry, offering disruptive solutions that cater to evolving consumer preferences and drive operational efficiency.

The seamless integration of technology into financial services has not only streamlined processes and reduced costs but has also expanded market reach and improved customer engagement. These advancements have positioned financial companies at the forefront of innovation, poised to capitalize on the opportunities presented by the digital economy and leverage emerging technologies to drive growth and optimize performance.

Looking Ahead: Sustaining Momentum and Managing Risks

As equities continue to ride the Go trend powered by financials, it is essential for investors to remain vigilant and proactive in managing risks and preserving capital in the face of evolving market conditions. While the current outlook appears favorable for financial sector stocks, unforeseen challenges and external factors could impact market dynamics and trigger fluctuations in asset prices.

By diversifying portfolios, conducting thorough research, and staying informed about market developments, investors can navigate the ever-changing landscape of equities and position themselves for long-term success. With a keen eye on potential catalysts and risk factors, investors can make informed decisions and capitalize on the opportunities presented by the dynamic and resilient financial sector.

In conclusion, the strong Go trend in equities powered by financials is indicative of the sector’s enduring strength and resilience in the face of uncertainty. With a potent combination of solid financial performance, rising interest rates, technological innovation, and strategic positioning, financial companies are well-positioned to lead the market higher and drive sustained growth in the months ahead. By staying informed, managing risks, and seizing opportunities, investors can navigate the complexities of the markets and reap the rewards of a bullish equity trend fueled by the financial sector’s unwavering momentum.