In the world of finance and investing, decisions around interest rates can have significant impacts on the performance of stocks and the overall economy. The debate between being bullish or bearish on rate cuts is often a hot topic among investors and analysts. This article aims to dissect the realities behind rate cuts and their implications on stock performance.

Understanding the Basics of Rate Cuts

When central banks decide to lower interest rates, their primary goal is to stimulate economic growth. By reducing borrowing costs, it becomes cheaper for businesses and individuals to access credit, leading to increased spending and investment. This can help spur economic activity and boost overall confidence in the market. However, the impact of rate cuts on stock performance is not always straightforward.

Historical Trends and Market Reactions

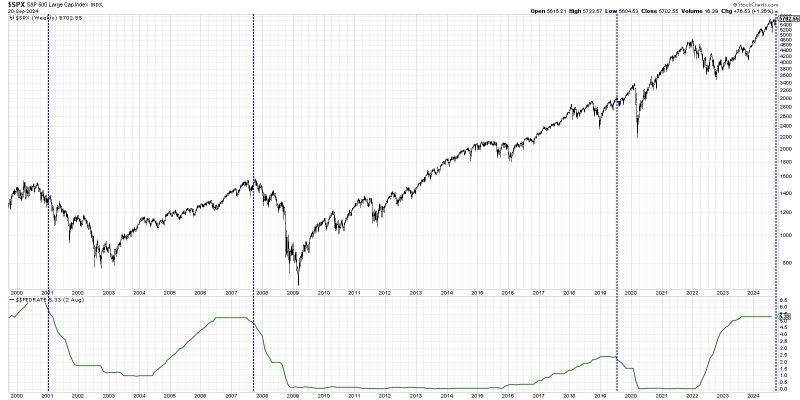

Historical data shows that rate cuts have often been followed by positive movements in the stock market. Investors tend to react positively to the prospect of lower borrowing costs, which can translate into higher stock prices. This trend is especially evident during periods of economic uncertainty or downturns when rate cuts are seen as a necessary tool to kickstart growth.

On the flip side, some analysts argue that prolonged periods of low interest rates can distort market dynamics and create asset bubbles. When rates are kept artificially low for an extended period, it can lead to excessive risk-taking by investors and a misallocation of resources. This can ultimately result in a market correction or even a crash when the bubble bursts.

Navigating the Uncertainties

For investors looking to position themselves in a rate-cut environment, it’s essential to consider a few key factors. Firstly, understanding the broader economic conditions and the rationale behind rate cuts can provide valuable context. Additionally, assessing the specific sectors and industries that are likely to benefit from lower rates can help guide investment decisions.

Moreover, staying informed about geopolitical events, trade tensions, and other external factors that can influence market sentiment is crucial. While rate cuts can provide a temporary boost to stock prices, they are not a panacea for all economic challenges. Diversification, risk management, and a long-term investment strategy remain essential elements of a successful investment approach.

In conclusion, the relationship between rate cuts and stock performance is multifaceted and can vary depending on the specific circumstances. While rate cuts can indeed provide a tailwind for stocks in the short term, investors should exercise caution and comprehensive analysis to navigate the complexities of the market. By staying informed, adaptable, and prudent in their decision-making, investors can position themselves to weather the uncertainties and capitalize on the opportunities presented by rate cuts.