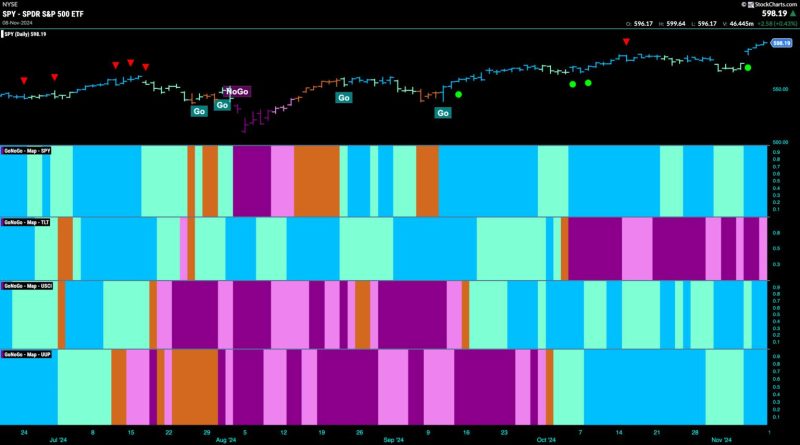

The recent resurgence in strength of the equity GO trend can be primarily attributed to the strong performance of financials, which has been a driving force behind the surge in prices across various markets. This shift towards equities has been welcomed by investors as it indicates a bullish outlook for the overall market sentiment.

In essence, the equity GO trend refers to the movement of capital towards stocks and away from other investment options like bonds or commodities. This shift can be influenced by several factors, including economic conditions, corporate earnings, and geopolitical events. In the current scenario, the financial sector has emerged as a key player in driving the price higher within this trend.

One of the key reasons behind the financial sector’s strong performance is the overall health of the economy. With strong economic indicators, such as low unemployment rates and robust GDP growth, investors are increasingly confident in the financial sector’s ability to generate returns. Additionally, the Federal Reserve’s commitment to maintaining low interest rates has also provided a boost to financial stocks, as this makes borrowing cheaper for businesses and consumers alike.

Furthermore, the financial sector has been resilient in the face of challenges such as the ongoing trade tensions and geopolitical uncertainties. By demonstrating stability and growth potential, financial institutions have garnered increased investor interest, leading to the surge in prices.

It’s worth noting that the equity GO trend is not limited to the financial sector alone. Other industries, such as technology, healthcare, and consumer goods, have also seen a boost in their stock prices as investors seek out high-growth opportunities. However, the financial sector’s outperformance stands out as a key driver behind the overall strength of the trend.

Looking ahead, the sustainability of the equity GO trend will depend on a variety of factors, including continued economic growth, corporate earnings performance, and central bank policies. While the financial sector has played a crucial role in driving prices higher, diversification remains key for investors looking to capitalize on the trend while managing risks effectively.

In conclusion, the recent surge in the equity GO trend, driven by the strength of the financial sector, underscores the resilience and attractiveness of equities as an asset class. Investors must monitor market dynamics closely and adapt their investment strategies accordingly to navigate the evolving landscape of the financial markets.