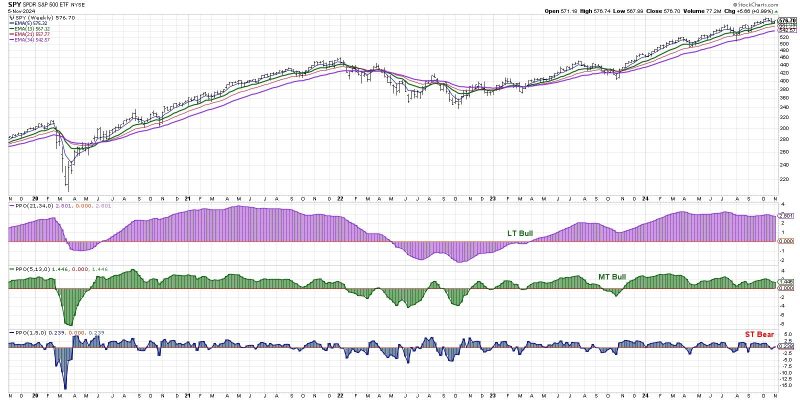

The market sentiments have been on a rollercoaster ride as investors brace themselves for a news-heavy week. Various factors are contributing to the short-term bearish signal seen in the markets. These signals are vital for traders to navigate through the volatile terrain.

One of the primary factors affecting market sentiment is the uncertainty surrounding global trade tensions. With ongoing trade disputes between major economies such as the U.S., China, and the European Union, investors are wary of the potential impact on the global economy. Any negative news related to trade talks can lead to a sell-off in the markets.

Another crucial element impacting market sentiment is the geopolitical tensions in various regions. Political instability, conflicts, and trade embargoes can all add to the uncertainty in the markets. Recent events in the Middle East and Asia have heightened geopolitical risks, leading investors to adopt a more cautious approach.

Furthermore, upcoming economic data releases and corporate earnings reports also play a significant role in shaping market sentiment. Investors closely monitor key economic indicators such as GDP growth, inflation rates, and employment data to gauge the health of the economy. Any deviations from expectations in these reports can trigger market volatility.

Moreover, the Federal Reserve’s monetary policy decisions have a direct impact on market sentiments. Investors closely watch the central bank’s stance on interest rates and its future outlook. Any hawkish or dovish signals from the Fed can sway investor confidence and lead to market movements.

In addition to these factors, external events such as natural disasters, pandemics, and technological disruptions can also influence market sentiments. The unexpected nature of these events can catch investors off guard, leading to sharp market reactions.

In conclusion, the short-term bearish signal in the markets is a reflection of the uncertainty and volatility prevailing in the global economy. Investors need to stay vigilant and adaptable to navigate through these turbulent times. By keeping an eye on key indicators, upcoming news events, and external factors, traders can make informed decisions to mitigate risks and capitalize on opportunities in the market.