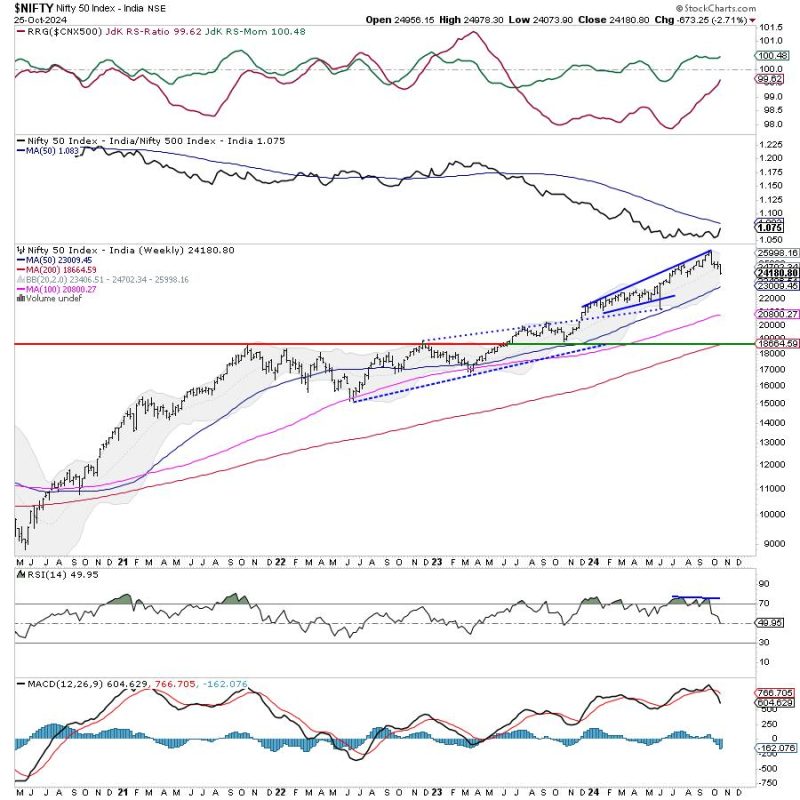

As we head into the new week, a notable shift has occurred in the Nifty as it has violated key support levels, subsequently dragging resistance lower. This development has sparked significant interest and concern among investors and traders alike. Let’s delve into the key aspects of this market movement and its potential implications.

The breach of crucial support levels is a pivotal event that can influence market sentiment and strategic decisions. Nifty’s failure to hold support suggests a weakening of the bullish momentum and could indicate a shift in the market trend. Traders who closely follow technical analysis may see this breach as a signal to reassess their positions and adjust their trading strategies accordingly.

On the other hand, the downward pressure on resistance levels further reinforces the bearish sentiment in the market. This decline in resistance indicates a lack of buying interest at higher levels, potentially leading to further downside movement in the near term. Traders who bet on a recovery or breakout above resistance levels may need to reconsider their outlook and factor in the current market dynamics.

The violation of key support levels and the subsequent drag on resistance can also impact broader market indices and sectors. Investors will likely monitor the Nifty’s performance closely to gauge the overall market sentiment and assess the potential risks and opportunities present in the current market environment.

In light of these developments, it becomes crucial for market participants to stay vigilant and adapt to the evolving market conditions. Employing risk management strategies, diversifying portfolios, and staying informed about market trends can help traders navigate the uncertainties and capitalize on opportunities that may arise in the wake of these changes.

As we navigate the week ahead, it will be interesting to see how the Nifty responds to these key technical levels and how market participants adjust their strategies in light of these developments. The interplay between support and resistance levels will continue to shape market dynamics, offering both challenges and opportunities for traders and investors seeking to navigate the ever-changing landscape of the financial markets.