Amidst ongoing market volatility and evolving economic conditions, investors are closely monitoring key levels in the Nifty index to anticipate potential market movements in the week ahead. By examining technical indicators and market trends, market participants can navigate this period of consolidation with a proactive approach. Traders are advised to remain attentive and disciplined in their trading strategies to capitalize on emerging opportunities and mitigate risks effectively.

The Nifty index has shown resilience in the face of recent market fluctuations, with strong support levels serving as a crucial buffer against downward pressure. As the index consolidates, maintaining a watchful eye on critical support and resistance levels will be essential for traders looking to make informed decisions. By setting clear entry and exit points based on these levels, investors can enhance their risk management and optimize their trading performance.

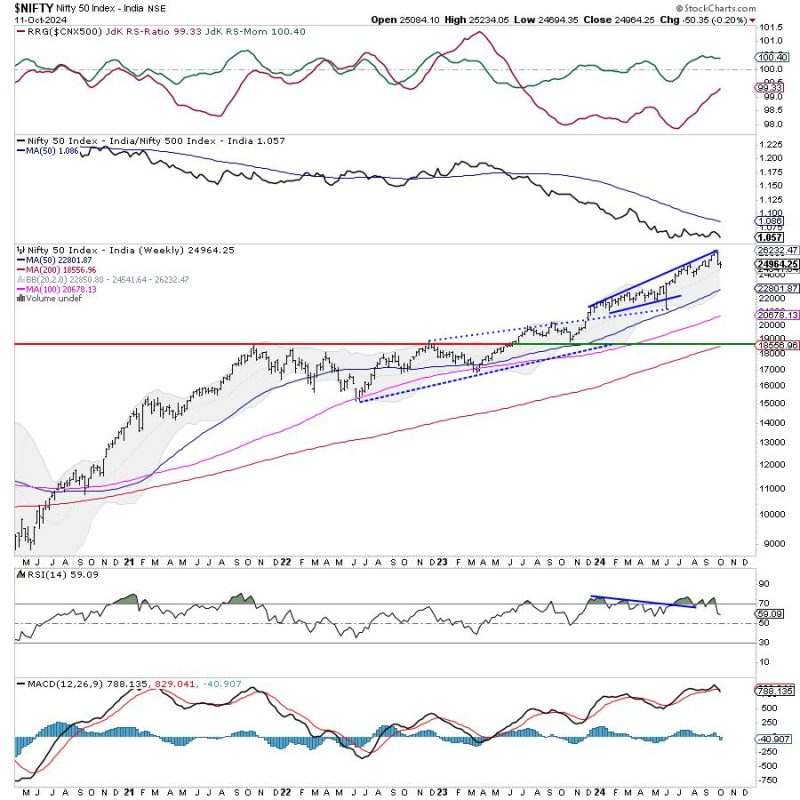

Technical analysis plays a vital role in mapping out potential scenarios for the Nifty index in the upcoming week. By utilizing tools such as moving averages, relative strength index (RSI), and Fibonacci retracement levels, traders can gain valuable insights into market sentiment and trend direction. Keeping a close watch on these indicators can help investors identify key inflection points and adjust their trading strategies accordingly.

In addition to technical analysis, staying informed about macroeconomic developments and global market trends is crucial for making well-rounded investment decisions. Factors such as interest rate changes, geopolitical events, and corporate earnings reports can impact market sentiment and drive price movements in the Nifty index. By staying abreast of relevant news and events, traders can adapt to changing market conditions and position themselves advantageously.

Risk management remains a cornerstone of successful trading, especially in times of market consolidation. Setting stop-loss orders, diversifying portfolios, and adhering to disciplined trading plans are essential practices for mitigating risks and maximizing returns. By maintaining a structured approach to risk management, traders can navigate market uncertainty with confidence and resilience.

In conclusion, the week ahead presents both challenges and opportunities for traders in the Nifty index. By staying vigilant, leveraging technical analysis tools, and remaining informed about key market developments, investors can position themselves strategically for success. With a focus on risk management and disciplined trading practices, traders can navigate the current market environment with resilience and agility, optimizing their chances for profitable outcomes in the days ahead.