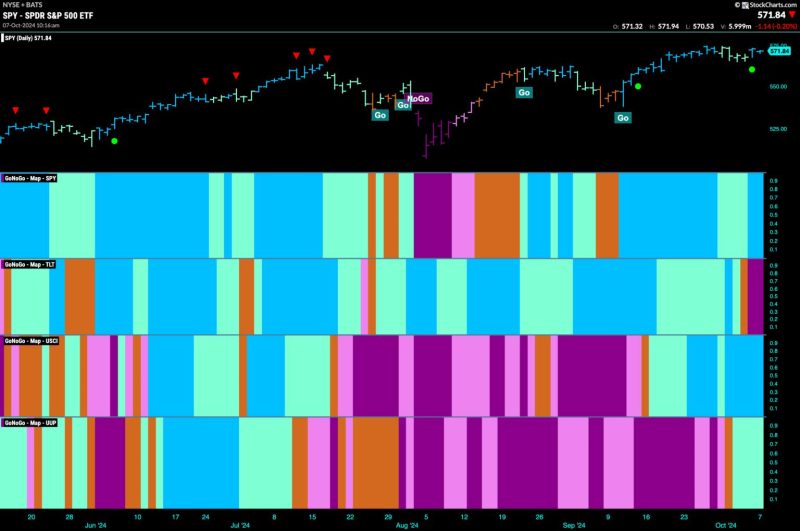

Equities Remain in Go Trend and Lean into Energy

The stock market continues to show strength and resilience as equities maintain their upward trajectory, signaling a Go trend for investors to capitalize on. Amidst the ongoing market turbulence, one sector that is currently in the spotlight is energy. Let’s delve into why equities are primed for growth and why investors are leaning into the energy sector for potential opportunities.

First and foremost, the prevailing Go trend in equities is evident from the sustained bullish momentum in various indices and individual stocks. Despite occasional pullbacks and bouts of volatility, the overall market sentiment remains positive, fueled by strong economic indicators and corporate performance. Investors are exhibiting confidence in the market’s ability to weather uncertainties and deliver solid returns in the coming months.

One key driver for the current market strength is the recovery in the energy sector. Energy stocks have been on a steady rise as oil prices rebound from historic lows seen during the height of the pandemic. The increasing demand for energy as economies reopen and global supply chains resume operations has bolstered the outlook for energy companies. This resurgence in the energy sector has piqued the interest of investors looking to capitalize on the sector’s growth potential.

Moreover, the energy sector’s performance is not just limited to traditional oil and gas companies. The shift towards renewable energy sources and sustainable practices has opened up new avenues for investment in clean energy companies. As the world transitions towards a low-carbon economy, renewable energy firms are poised to benefit from increased government support, growing consumer demand, and technological advancements in the sector. This transition presents a lucrative opportunity for investors to tap into the burgeoning clean energy market.

In addition to the energy sector, other industries such as technology, healthcare, and consumer goods continue to show promise for investors seeking diversification and growth opportunities. The resilience of these sectors in the face of economic challenges further reinforces the Go trend in equities and underscores the importance of a well-rounded investment strategy.

As investors navigate the dynamic market environment, it is crucial to stay informed, conduct thorough research, and seek professional advice to make informed investment decisions. While the current market conditions favor equities and present opportunities for growth, it is essential to remain vigilant and adaptable to market developments.

In conclusion, equities remain in a positive trend, with the energy sector emerging as a focal point for investors. By leaning into the energy sector and diversifying across industries, investors can position themselves for potential growth and capitalize on the prevailing market dynamics. As the market continues to evolve, staying proactive and strategic in investment decisions will be key to navigating the ever-changing landscape of equities.