In recent days, market movements have been closely watched and analyzed. The Nifty index has been a significant point of focus for many investors as they seek to understand the trends and potential outcomes. This article delves into the market dynamics and provides valuable insights into the factors driving these movements.

One of the key factors influencing the market is the ongoing global economic uncertainties. The Nifty index has been particularly sensitive to global developments, especially in light of the prevailing economic conditions. As such, market participants are closely monitoring geopolitical events, trade tensions, and economic indicators to gauge the potential impact on the Nifty.

Furthermore, domestic factors are also playing a crucial role in shaping market movements. The upcoming earnings season, policy decisions by regulatory bodies, and domestic economic data are all contributing to the market sentiment. Investors are eagerly awaiting corporate earnings reports to assess the financial health of companies and to gauge the overall economic outlook.

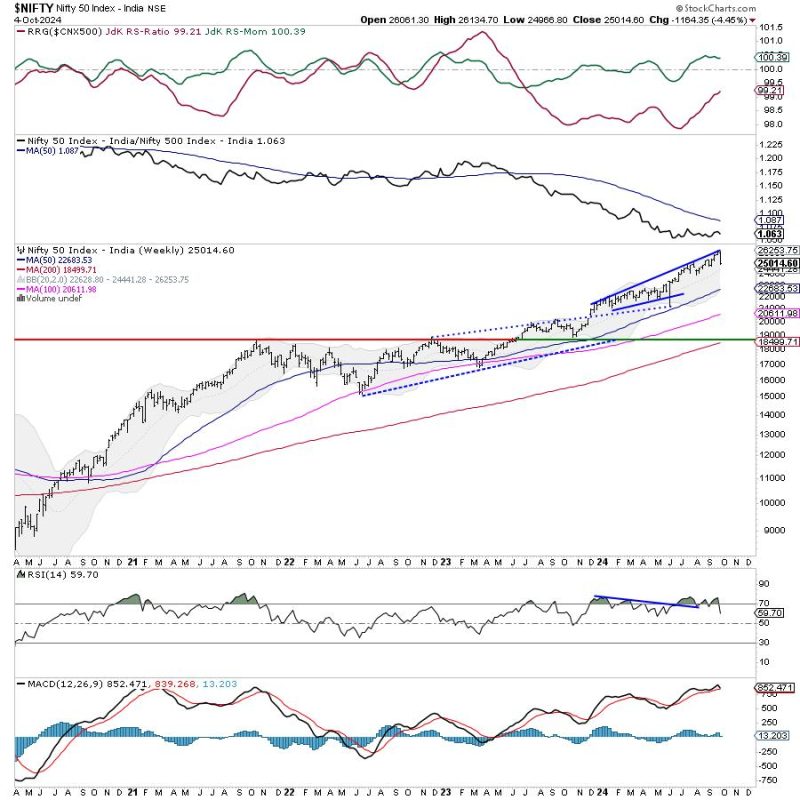

Technical analysis is another crucial tool being used to interpret market movements. By studying historical price data and chart patterns, analysts can identify potential trends and support/resistance levels. This analysis helps traders make informed decisions regarding entry and exit points, as well as potential price targets.

Moreover, market sentiment and investor psychology are also critical in understanding market movements. Sentiment indicators, such as the fear and greed index, provide valuable insights into the prevailing mood among market participants. By monitoring these indicators, traders can gauge potential market reversals or trends.

It is essential for investors to maintain a long-term perspective when analyzing market movements. While short-term fluctuations may create opportunities for traders, a focus on long-term trends and fundamentals is crucial for sustainable investments. By conducting thorough research, staying informed about market developments, and exercising discipline, investors can navigate market volatility and make informed decisions.

In conclusion, market movements, particularly those of the Nifty index, are influenced by a myriad of factors, both domestic and international. By considering economic indicators, technical analysis, market sentiment, and investor psychology, traders can gain valuable insights into potential market trends. It is essential for investors to maintain a long-term perspective, conduct thorough research, and stay informed to navigate market uncertainties successfully.