Sector Rotation Dilemma: Balancing Risk and Opportunity

Investing in the stock market involves navigating a complex landscape of industries and sectors, each with its own unique dynamics and considerations. One approach that investors often use to manage market volatility and maximize returns is sector rotation, the practice of shifting investment allocations between different sectors based on economic conditions and market trends. While sector rotation can offer opportunities for diversification and potentially higher returns, it also presents a dilemma for investors as they seek to balance risk and opportunity.

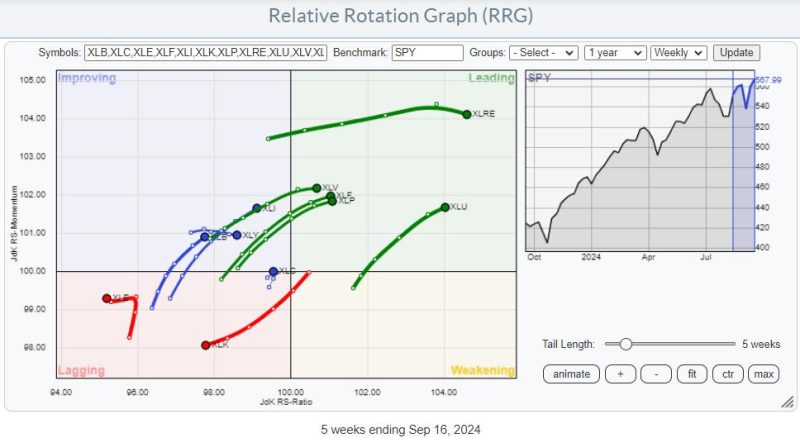

The primary goal of sector rotation is to capitalize on the varying performance of sectors at different stages of the economic cycle. For instance, defensive sectors like utilities and consumer staples tend to outperform during economic downturns, while cyclical sectors like technology and industrials may do better during periods of economic expansion. By monitoring economic indicators and market trends, investors can adjust their sector allocations to take advantage of these shifting dynamics.

However, the success of sector rotation strategies relies on accurate market timing and the ability to predict sector outperformance with precision. Market timing is notoriously difficult, and even the most seasoned investors can struggle to consistently identify the best sectors to invest in at any given time. This challenge is exacerbated by the fact that sectors can be influenced by a wide range of factors beyond the broader economic cycle, including regulatory changes, technological advances, and geopolitical events.

Moreover, sector rotation introduces a level of complexity and active management that may not be suitable for all investors. Constantly adjusting sector allocations can lead to higher trading costs and tax implications, potentially eroding returns over time. Additionally, sector concentration risk is a key consideration, as overexposure to a particular sector can leave a portfolio vulnerable to sector-specific downturns.

Despite these challenges, sector rotation can offer important benefits for investors who are able to navigate its complexities effectively. Diversifying across sectors can help reduce portfolio volatility and enhance risk-adjusted returns, particularly in volatile market environments. Moreover, sector rotation strategies can provide exposure to a broad range of industries, allowing investors to capitalize on emerging trends and opportunities for growth.

To strike the right balance between risk and opportunity in sector rotation, investors should consider a few key principles. First, diversification is essential to mitigate sector-specific risks and ensure a well-rounded portfolio. Second, a disciplined and systematic approach to monitoring market trends and economic indicators can help inform sector allocation decisions. Finally, maintaining a long-term investment horizon and avoiding excessive trading can help minimize transaction costs and optimize returns over time.

In conclusion, sector rotation presents both challenges and opportunities for investors seeking to navigate the complexities of the stock market. By understanding the dynamics of different sectors, staying informed about market trends, and adopting a disciplined investment approach, investors can effectively manage the sector rotation dilemma and position themselves for long-term success in the ever-changing world of investing.