The week ahead looks to be tentative for Nifty as a defensive setup starts to develop, impacting market sentiment and trading levels. It is crucial for investors and traders to keep a close watch on specific support and resistance levels to navigate smoothly through the market dynamics.

Support and Resistance Levels

One of the fundamental aspects that traders and investors must closely monitor during such uncertain times is the support and resistance levels for Nifty. These levels provide crucial insights into potential market movements and help in making informed trading decisions.

Currently, the Nifty has formed a short-term support zone around the 15,700 mark. Traders should watch this level closely as a breach below it could signal further downside potential. On the upside, a decisive move above the 15,900 mark could indicate a renewed bullish momentum in the market.

Technical Indicators

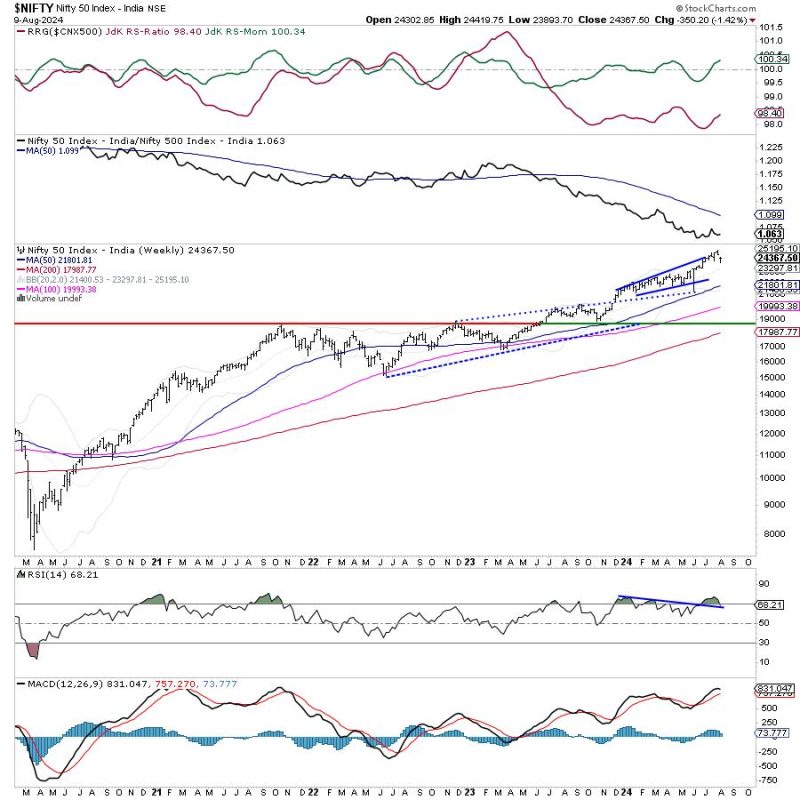

Technical indicators play a significant role in determining the overall market sentiment and trend direction. In the current scenario, indicators like the Relative Strength Index (RSI) and Moving Averages can provide valuable insights for traders.

The RSI for Nifty is hovering around the 50 mark, indicating a neutral stance in the market. Traders should pay attention to any significant changes in the RSI levels, as it could signal a potential shift in market momentum.

Additionally, moving averages like the 50-day and 200-day Moving Averages can act as dynamic support and resistance levels, guiding traders in identifying key levels for entry and exit points.

Market Volatility

Volatility is an inherent characteristic of the stock market, and during times of uncertainty, it becomes even more crucial to manage and understand market volatility effectively. Traders should be prepared for sudden price fluctuations and take necessary risk management measures to safeguard their positions.

Utilizing volatility indicators like the Average True Range (ATR) can help traders gauge the extent of price movements and adjust their trading strategies accordingly. It is essential to factor in market volatility while setting stop-loss levels and defining profit targets to mitigate potential risks.

Market Sentiment

Market sentiment plays a vital role in shaping the overall trend and direction of the stock market. During periods of defensive setups, investors tend to adopt a cautious approach, leading to fluctuations in market sentiment.

Tracking market sentiment indicators like the Fear and Greed Index can provide valuable insights into investor psychology and help traders anticipate potential market reversals. Understanding market sentiment can help traders navigate through choppy market conditions and make informed trading decisions.

In conclusion, the upcoming week for Nifty is likely to remain tentative as a defensive setup develops, influencing market sentiment and trading levels. By closely monitoring support and resistance levels, analyzing technical indicators, managing market volatility, and tracking market sentiment, traders can adapt their strategies and navigate through the evolving market dynamics successfully.