The first quarter financial results for S&P 500 companies in 2024 have been released, providing a snapshot of the current state of the market. Despite the promising performance of many companies, concerns about the overvaluation of the market persist. Let’s delve into the key insights from the Q1 2024 earnings results and examine the underlying factors contributing to the market’s perceived overvaluation.

Earnings Growth and Performance

One of the standout aspects of the first quarter earnings results is the strong earnings growth exhibited by many S&P 500 companies. Several sectors, including technology, healthcare, and energy, reported robust financial performance, surpassing analysts’ expectations. This growth is indicative of the ongoing economic recovery and the resilience of large corporations in navigating challenging market conditions.

However, while the earnings growth appears impressive on the surface, it is essential to analyze the underlying factors that are driving these results. Factors such as cost-cutting measures, supply chain optimizations, and favorable economic conditions have played a significant role in boosting corporate earnings. It is crucial to assess whether this growth is sustainable in the long term or merely a temporary effect of current market dynamics.

Valuation Concerns and Market Overvaluation

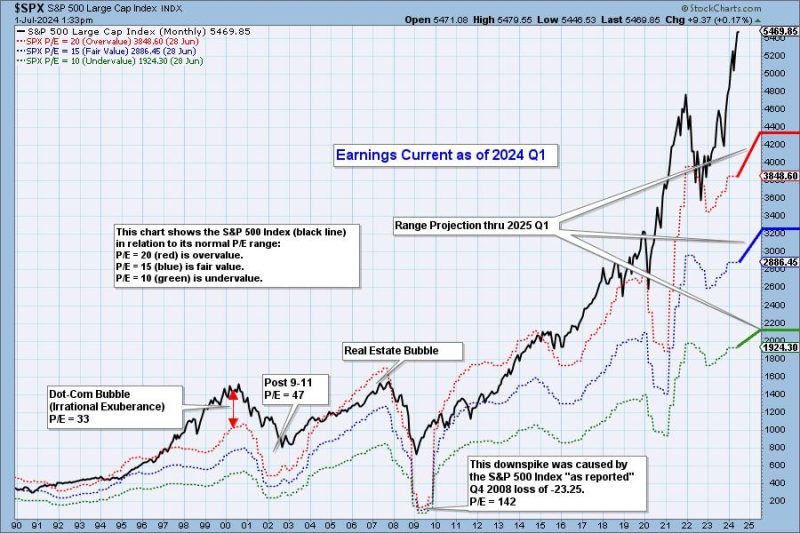

Despite the positive earnings performance of many companies, concerns about the overvaluation of the market persist. The Price-to-Earnings (P/E) ratio of the S&P 500 remains elevated, signaling that investors are willing to pay a premium for stocks relative to their earnings. While high P/E ratios are not inherently problematic, they can indicate that stocks are becoming overvalued and may be susceptible to a market correction.

The overvaluation of the market is further exacerbated by other factors such as low interest rates, abundant liquidity, and speculative trading activity. These conditions have created a favorable environment for stock price appreciation but have also raised concerns about the sustainability of current market levels. Investors must remain cautious and conduct thorough due diligence when evaluating investment opportunities in such a market environment.

Risk Factors and Uncertainties

Several risk factors and uncertainties loom over the market, posing potential challenges to the ongoing rally in stock prices. Geopolitical tensions, inflationary pressures, supply chain disruptions, and regulatory changes are just a few of the factors that could derail the current market momentum. Additionally, the Federal Reserve’s monetary policy decisions and the trajectory of interest rates will influence market sentiment and investor behavior in the coming months.

It is imperative for investors to remain vigilant and diversify their portfolios to mitigate risks associated with market volatility and overvaluation. Conducting thorough research, seeking professional advice, and staying informed about macroeconomic trends are crucial steps in navigating the complex and dynamic landscape of the stock market.

In conclusion, the first quarter earnings results for S&P 500 companies in 2024 provide valuable insights into the current state of the market. While many companies have delivered strong financial performance, concerns about the overvaluation of the market persist. Investors must remain cautious, assess risk factors, and make informed decisions to navigate the uncertainties and challenges of the evolving market environment.